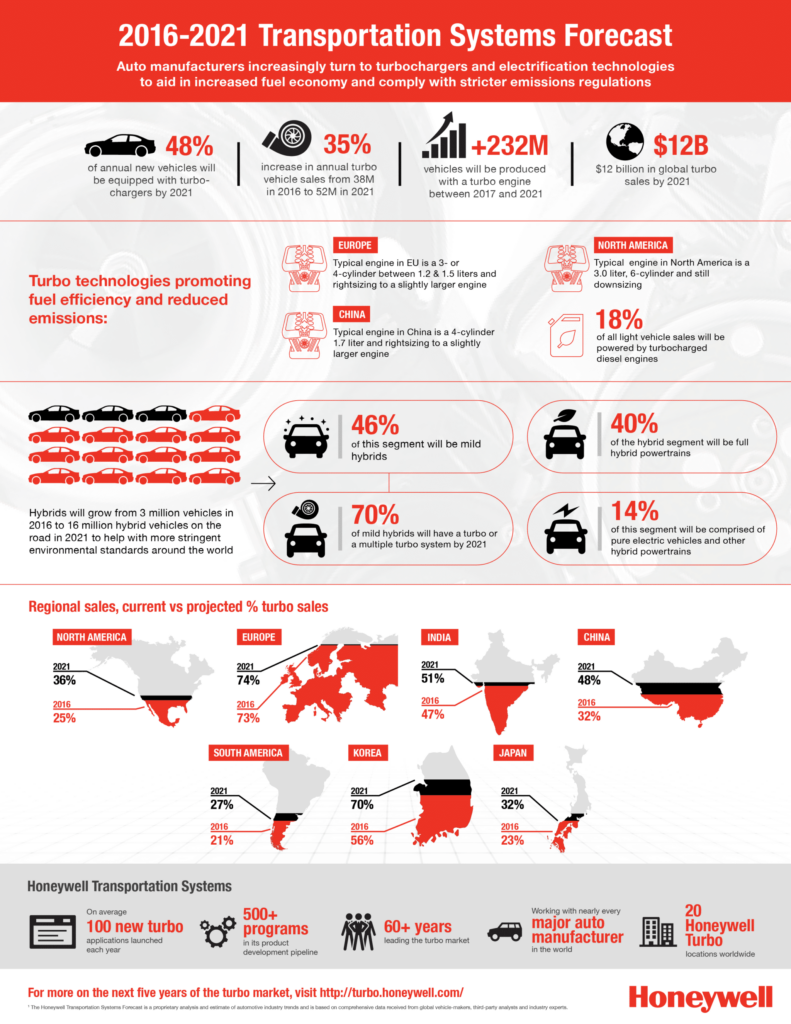

Garrett FORECAST sees global annual sales of TURBOCHARGED VEHICLES increasing 35 percents by 2021 and outpacing total industry CAGR 3 TO 1

- By 2021 turbo vehicle sales to reach 52 million annually, up from 38 million in 2016

- Need for cleaner, more efficient transportation will drive pairing of turbo with electrification

- China still fastest growing region; United States leads double-digit growth for North America

Garrett Motion Forecast sees automakers continuing to adopt turbocharging technology to the tune of 48 percent of annual global sales by 2021, up 9 percentage points from 2016. This annual sales estimate, combining both passenger and commercial vehicles, would add more than 232 million turbocharged vehicles globally between 2017 and 2021 — an increase of 35 percent from today.

“As emission regulations continue to tighten, mature automotive markets like the United States and high-growth regions like China and India are turning to turbochargers to help provide cleaner transportation. This is creating what we refer to as the ‘Golden Age of Turbo,’” said Olivier Rabiller, Garrett Motion President and CEO. “With the ability to improve emissions and fuel economy by 20 to 40 percent in gas and diesel engines, turbocharging technology is a smart choice for helping automakers meet tougher global emissions standards without sacrificing performance.”

This year’s forecast recognizes an industry trend for slightly bigger engine sizes in Europe and China as automakers adapt powertrain strategies to tackle updated emissions regulations developed for real-world driving conditions. In these regions, a typical powertrain is a three- or four-cylinder engine with a displacement size between 1.2 liters and 1.7 liters. By rightsizing engines with available technologies, automakers are able to continue applying the benefits of smaller turbocharged engines while fine-tuning powertrain systems to further optimize fuel economy, emissions and performance.

In addition, Garrett’s forecast calls for electric boosting products to help support compliance with more stringent national environmental standards. To this end, it is anticipated that the industry will begin moving from 12-volt battery systems to 48-volt systems. This change opens the door for a cost-effective electric boosting technology solution featuring e-chargers and e-turbos to help improve efficiency and performance of the internal combustion engine in a mild hybrid vehicle. E-boosting products can dramatically improve engine responsiveness and also provide better fuel economy. Specific to diesel, it also has the potential to significantly reduce pollutant emissions, like mononitrogen oxide (NOx), and help meet more stringent regulations including the Real-Driving Emissions test in Europe.

Electrics and hybrids are expected to grow from a total of 3 million vehicles in 2016 to a total of 16 million by 2021. Within the electrified category, mild hybrids are expected to account for 46 percent of the mix; full hybrids will account for 40 percent; and pure electric vehicles will be most of the remaining 14 percent. Garrett estimates 70 percent of all mild hybrid vehicles will have a turbo or multiple turbo systems (mechanical and electric). In addition, Garrett has drawn upon its engineering competencies in the automotive and aerospace industries to create a new two-stage electrical compressor used by Honda Motor Co. for its hydrogen-powered Clarity Fuel Cell vehicle.

More Key Global Findings

- The projected increase in annual sales of vehicles with a turbo from 38 million today to 52 million in 2021 equates to a 35 percent increase, or 6 percent CAGR (compounded annual growth rate) compared with a 2 percent CAGR for all global industry sales.

- The global turbo business is expected to reach almost $12 billion in industry sales in 2021.

- Globally, diesel engines will retain a significant share of global light vehicle sales at nearly 18 percent, due to their lower fuel consumption and carbon dioxide (CO2) emissions. Diesel engines also provide increased torque, range and driving pleasure especially for pickup trucks, SUVs and light commercial vehicles, which remain extremely popular.

- Vehicle complexity will increase with the onboarding of new technology, making automotive software such as OnRAMP Design Suite a key enabler for meeting more stringent emission regulations. The automotive industry currently spends between $2 billion and $4 billion a year just on the development and calibration of powertrain controls to manage a vehicle’s engine and after-treatment functions such as diagnostics. OnRAMP can reduce development time from months to days as well as help optimize engine controls of subsystems designed to reduce CO2 and other emissions.

Regional Highlights

- In North America, more engine downsizing is expected. The current average engine size is a 3.0-liter six-cylinder. As the region continues to shift from larger naturally aspirated engines to smaller turbocharged ones, Garrett is working to provide more twin-scroll turbo technology support, which extracts more energy from four-cylinder exhaust profiles. Garrett expects light vehicle sales of turbocharged vehicles to grow 11 points to 33 percent of regional sales or more than 7 million vehicles by 2021. Turbocharged diesel engines will continue to be in demand on light-duty trucks.

- Europe will easily remain the global leader with an overall turbo penetration of 74 percent. The mix between gasoline and diesel will shift slightly as gas turbo penetration in light vehicle sales grows 9 points to 52 percent in 2021. Additional technology benefits are needed as many automakers still have a gap of 15 to 30 g/km before meeting the 2021 target of 95 g/km.

- In China, emissions regulations are scheduled to become the toughest in the world. These new rules will favor the development of gasoline turbocharged engines and wider adoption of electrification. China will be the highest growth market for turbocharged light vehicles with a 17 percent increase in penetration of total sales. This equates to an expected 80 percent increase in the number of annual sales in 2021 at more than 13.5 million versus 7.5 million in 2016. Garrett is supporting this massive turbo adoption in China especially in the three-cylinder engine segment using its third-generation gas technology. This features a wastegate with a Garrett-developed mono-block arm and valve, reducing noise by 5 to 10 decibels and improving fuel economy by up to 0.5 percent with better controllability and 50 percent less wear due to repetitive motion within the turbo housing.

- Other regions including Japan, Korea, India and South America will see on average a 7 percent growth in turbocharging volume driven by the expected recovery of South America and Southeast Asia economies, and more stringent regulations including India’s Bharat Stage 6 and Brazil’s Inovar-Auto and future programs.

Additional Quotes

“Garrett continues to develop turbo innovations that enable automakers to push the limits of powertrain development. As turbocharging has grown in the past 10 years from being a largely commercial vehicle and diesel technology in Europe to a global technology benefitting gasoline engines, automakers are gaining valuable experience influencing current and future powertrain designs.

“We’re excited at Garrett to help our customers with this next phase of development as powertrain optimization has led to even more aggressive engine developments using alternative engine combustion cycles, electrification, multistage boosting, advanced compressors for hydrogen fuel cells and greater use of engine management software such as OnRAMP to provide greater fuel economy and performance.”

— Craig Balis, SVP and Chief Technology Officer Garrett

“An example of the rightsizing we are seeing in Europe would be the 2.0-liter engine of five to seven years ago that became a downsized 1.0-liter with a turbocharger. Going forward, that same engine may evolve to a 1.2-liter to 1.5-liter turbocharged engine to help retain the fuel economy and emission benefits of a smaller engine than the original, and still account for real-world driving habits of consumers while meeting regulatory targets.”

— Pierre Barthelet, Garrett Motion Chief Marketing Officer

Methodology

Garrett’s annual Transportation Systems industry forecast looks at the next five years of transportation technology trends including turbo penetration as well as the growing use of automotive software and electric boosting products among anticipated global vehicle sales.

Garrett’s forecast methodology is based on multiple sources including, but not limited to, macroeconomic analyses, original equipment manufacturers’ production and development plans shared with the company, and expert deliberations from automotive industry. The survey sample is representative of the entire industry in terms of geography, operation and fleet composition. This comprehensive approach provides Garrett with unique insights into Automotive OEM sentiments, preferences and concerns, and provides considerable insight into product development needs and opportunities.