Unmatched advancements

Corporate Newsreel

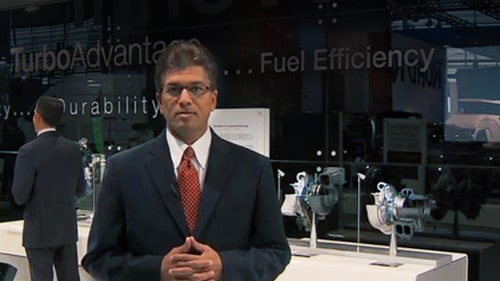

CLEPA – Future as we move: Olivier Rabiller President and CEO of Garrett Motion

The mobility landscape is changing, but what is coming next? CLEPA, the European Association of Automotive Suppliers, sat down with select suppliers to discuss the future of mobility.

Watch along Garrett Motion President and CEO Olivier Rabiller discusses how the industry is evolving, what is coming next, and the roles that suppliers play in its success.

In the area of emissions, we need to not just look at tailpipe emissions, but take a so-called ‘well-to-wheel’ approach. We also need to look at the entire lifecycle of the automotive products from manufacturing all the way to recycling.” Olivier Rabiller, President and CEO, Garrett Motion

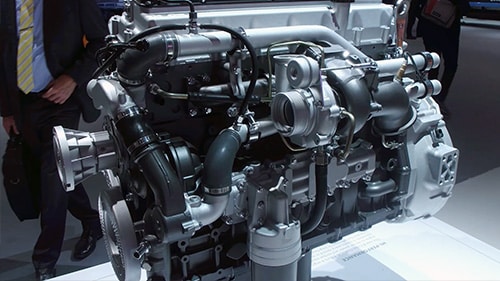

“This transformation requires a wide breadth of technologies to fit various needs,” says Rabiller in the video interview. “For us, as a global Tier 1 supplier, we are doing this by providing new differentiated technologies that allow automakers to improve performance, increase fuel economy, reduce emissions, and support electrification and connectivity – all of that at a cost that should stay acceptable for the end-consumer.